The global fintech market is estimated to be worth USD 165.17 billion in 2023, growing at a CAGR of 25.18%. It is set to surpass USD 400 billion by 2027.

With over 26,000 fintech startups launched in 2021, the estimated digital payments made in 2022 are USD 8.49 trillion. (source: https://www.marketdataforecast.com/market-reports/fintech-market)

The fintech industry has grown exponentially, making financial transactions more accessible than ever. However, with this convenience comes a significant threat—payment fraud.

In this article, we delve into the world of payment frauds, their impact, and how fintech companies can implement robust fraud prevention strategies.

Join us on this journey to secure your fintech business and protect your customers.

Understanding Payment Fraud in APAC: A Growing Concern

Payment frauds encompass various deceptive practices that can cripple fintech companies. From phishing attacks to identity theft, these frauds take various forms, endangering financial institutions and their customers. While digitized frauds are a global concern, the APAC region has witnessed a significant increase in their occurrences, particularly at the beginning of the COVID-19 pandemic (source: https://www.theasianbanker.com/updates-and-articles/technology-a-double-edged-sword-for-financial-fraud-risk-management).

Several factors contribute to this growing concern.

- Rapid fintech growth with a large unbanked population gaining access to digital financial services

- Diverse payment methods, from mobile wallets to digital payment platforms

- A high volume of cross-border transactions with a complex payment system

- Challenges in fintech regulations in APAC

These have attracted the attention of fraudsters to exploit vulnerabilities.

Common Types of Payment Fraud

To combat payment frauds effectively, we must first understand their intricacies. We explore common fraud types, including

- Phishing: A type of scam that involves the use of fraudulent emails, websites, or SMS to trick people into revealing their personal information, such as password or credit card numbers

- Identity theft: A fraudster steals a person’s personal information, such as name, security number or credit card numbers. 61% of merchants in APAC reported higher rates of identity theft (source: https://www.cybersource.com/en-ap/solutions/fraud-and-risk-management/fraud-report.html)

- Account takeovers (ATO): A hacker gains unauthorized access to an online account with malicious intent. 142% increase in ATO in APAC (source: https://www.cybersource.com/en-ap/solutions/fraud-and-risk-management/fraud-report.html)

Fraudsters will then use these stolen information to make unauthorized purchases or open accounts in the victim’s name. This leads to the loss on both parties, businesses and consumers.

Many real-world examples shed light on these threats, emphasizing the need for robust prevention measures.

The Consequences of Payment Frauds

Payment frauds inflict severe consequences on fintech companies. The toll is substantial, from financial losses to reputational damage and legal ramifications.

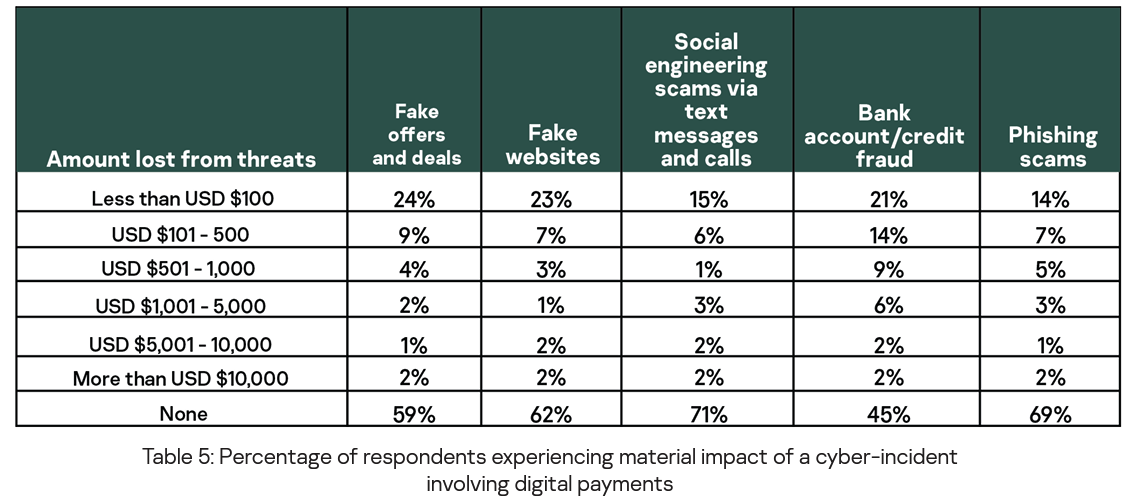

According to an Asia Pacific Study by Kaspersky 2021, the material impact of cyber-incidents involving digital payments, the top 5 threats resulting in financial loss are—fake offers and deals, fake websites, social engineering scams via text messages and calls, bank account/credit fraud, and phishing scam.

According to Fintech News Singapore, APAC countries lose an average of USD 4 per transaction due to fraud.

The statistics are alarming, with payment frauds causing massive losses in the fintech sector. These statistics emphasize the urgent need for fintech companies operating in APAC to prioritize robust payment fraud prevention measures.

As the region continues to drive fintech innovation and digital financial inclusion, staying ahead of fraudsters is paramount to ensure the safety and trust of customers in the rapidly evolving APAC fintech landscape.

The loss of customer trust stands out as a significant consequence, further underscoring the urgency of prevention.

Building Security into The Customer Experiences: Best Practices for Payment Fraud Prevention

1. Onboarding: Securing Entry Points

The onboarding process serves as the first line of defense when preventing payment fraud.

It involves implementing stringent measures such as robust KYC (Know Your Customer) processes, email, phone, IP, and device lookup during sign-up and login, and two-factor authentication (2FA).

Here, we'll delve into the role of 2FA in preventing fraud and offer tips for enhancing user authentication processes.

Two-Factor Authentication (2FA): The Fraud Buster

Two-factor authentication, often abbreviated as 2FA, is a fundamental tool in the arsenal against payment fraud. It serves as an additional layer of security beyond the traditional username and password.

Here's how it works:

- Something You Know: This is typically your standard log in information, such as a username and password.

- Something You Have: The second factor usually involves something physical only the legitimate user possesses. This can be a mobile device, a personal identity verification card, a smart card, or a token generator.

- Something You Are: This factor involves biometric authentication, such as fingerprint or facial recognition.

- Somewhere You Are: This factor is location-based. The most common way to detect a user’s location is by identifying the Internet Protocol (IP) addresses.

- Something You Do: This factor is possibly the least utilized as it is not known by many. It involves identities by observing actions—gestures or touches.

A system may use one or more factors for authentication. For instance, it is typically called Multi-Factor Authentication (MFA) for two factors and above.

Regardless of the authentication methods used, the key role of 2FA is to ensure that even if a fraudster obtains a user's login credentials (the "Something You Know" factor), they would still be unable to access the account without the second authentication factor.

Tips for Enhancing User Authentication Processes

- Biometric Authentication: Consider integrating biometric authentication methods like fingerprint or facial recognition into your 2FA process. These are exceptionally secure and difficult to fake.

- SMS Verification: Sending a one-time code to the user's registered mobile number via SMS is a standard 2FA method. However, be cautious with SMS-based 2FA, as SIM swapping attacks can bypass this method. Encourage users to contact customer support if they suspect any unauthorized SIM changes.

- Authentication Apps: Utilize authentication apps like Google Authenticator or Authy. These apps generate time-based one-time codes (TOTPs) that expire quickly, adding an extra layer of security.

- Push Notifications: Consider using push notifications to a registered mobile device for user authentication. Users can approve or deny login attempts directly from their devices.

- Geolocation Verification: Track the user's geolocation during login. If a login attempt originates from an unusual or suspicious location, trigger additional authentication steps.

- Device Fingerprinting: Create a unique fingerprint of each user's device during login. If a login attempt is made from a device with an unfamiliar fingerprint, prompt additional verification.

- Behavioral Analytics: Implement behavioral analytics to identify deviations in user behavior patterns. For example, suppose a user typically logs in from a specific IP address and suddenly attempts to log in from a different one. In that case, it can raise an alert for further authentication.

- Regular Security Checks: Periodically prompt users to review and update their security settings, including their 2FA preferences. This ensures that users stay engaged with their account security.

By adopting these tips and incorporating 2FA into user authentication processes, fintech platforms can significantly enhance their fraud prevention capabilities.

These methods add layers of security that make it increasingly challenging for fraudsters to gain unauthorized access, ultimately safeguarding both users and the platform from payment fraud.

2. Browsing: Early Detection of Threats

As users interact with fintech platforms, their browsing activities provide valuable insights.

To detect payment frauds in their early stages, fintech companies actively monitor these activities. Advanced algorithms, often powered by artificial intelligence (AI), are deployed to recognize and flag suspicious patterns.

For instance, if a user's browsing behavior suddenly deviates from their norm, it could raise an alert.

This might manifest as

- unusual login times,

- multiple failed login attempts, or

- erratic navigation through the platform.

These deviations can serve as early warning signs of potential payment fraud attempts.

Swift action is crucial in response to these early indicators.

Fintech companies should have protocols in place to investigate and respond to flagged activities promptly.

This may involve additional verification steps, temporary account freezes, or communication with the user to confirm the legitimacy of their actions.

3. Transacting: Real-Time Vigilance

Payment fraud prevention doesn't end once a user is onboarded or while they're browsing; it extends into the heart of transactions.

Real-time transaction monitoring is a pivotal practice in detecting and preventing payment frauds.

In this phase, fintech companies actively scrutinize every transaction taking place on their platform.

They look for irregularities, patterns, or behaviors that deviate from the norm.

For example, if a user suddenly attempts to make a high-value transaction that's out of sync with their usual spending habits, it could trigger an alert.

Machine learning models play a significant role in this process.

These models analyze transaction data at lightning speed, detecting anomalies that might be indicative of fraud.

These anomalies could include unusually large transactions, rapid successive transactions, or transactions from unusual locations.

The system can trigger alerts or temporarily halt the transaction for further verification when these anomalies are detected.

This proactive approach ensures that potentially fraudulent transactions are halted in their tracks, protecting both the user and the fintech platform.

4. Returning: Safeguards Post-Transaction

Payment fraud risks don't disappear once a transaction is completed.

Returning users are still vulnerable to various threats, such as unauthorized electronic fund transfers or transactions made without their consent.

Fintech companies implement safeguards that allow users to report suspicious activities post-transaction.

This reporting mechanism is crucial for timely intervention and resolution.

Users should have accessible channels to reach out to customer support if they suspect any fraudulent activity on their account.

Customer support's responsiveness in addressing these concerns is vital.

If a user reports a transaction they did not authorize or suspects their account has been compromised, fintech companies must act swiftly.

Investigations should be launched to verify the claim; if it's substantiated, necessary steps must be taken to rectify the situation.

In essence, the post-transaction phase is about ensuring that users feel secure and supported throughout their fintech journey. This trust-building aspect is essential in maintaining a loyal customer base and protecting against the potential fallout of payment frauds.

Using Technology for Payment Fraud Prevention

Technology is pivotal in safeguarding fintech companies and their customers from the ever-evolving threat landscape of payment frauds. Fintech firms increasingly turn to advanced technological solutions to detect, prevent, and mitigate these risks. This section will explore how technology, particularly artificial intelligence (AI) and machine learning, is harnessed for robust payment fraud prevention.

Harnessing AI and Machine Learning

- Real-time Transaction Monitoring: AI-driven algorithms are employed to scrutinize every transaction in real-time. These algorithms can identify patterns and anomalies that go unnoticed by traditional rule-based systems. For instance, they can flag transactions with unusual amounts, frequencies, or geographic locations, triggering immediate alerts for further investigation.

- Behavioral Analytics: Machine learning models analyze vast datasets of user behavior to create baseline profiles. Any deviation from these baselines, such as sudden changes in spending habits or irregular login locations, can raise red flags. These models adapt to emerging fraud tactics by continuously learning from new data.

- Predictive Modeling: Machine learning enables the development of predictive models that assess the risk associated with each transaction or user. These models assign risk scores, helping fintech platforms prioritize investigations and allocate resources efficiently.

- Biometric Authentication: Biometric technologies, including facial recognition and fingerprint scanning, are increasingly integrated into user authentication processes. These biometric data points add an extra layer of security, making it extremely challenging for fraudsters to impersonate legitimate users.

- Pattern Recognition: AI-powered systems excel at identifying complex patterns within vast datasets. This capability is beneficial for recognizing fraudulent behaviors, such as account takeover attempts, before they result in financial losses.

Specific Tools and Services

Beyond AI and machine learning, fintech companies have access to a wide array of specialized tools and services designed for fraud prevention.

These tools enhance the effectiveness of existing fraud prevention strategies:

- Fraud Detection Platforms: Comprehensive fraud detection platforms offer multifaceted protection. They combine AI-driven analytics with rule-based systems to provide real-time alerts and risk assessments.

- Anti-Phishing Solutions: With the rise of phishing attacks, anti-phishing solutions employ advanced algorithms to detect and block fraudulent websites and emails. They safeguard users against unwittingly providing sensitive information to malicious actors.

- Identity Verification Services: Third-party identity verification services offer robust identity checks using various data sources. These services ensure that customers are who they claim to be, reducing the risk of identity theft-related fraud.

- API Security: Fintech firms leverage API security solutions to safeguard the integrity of data exchanges with partners and third-party applications. These solutions prevent data breaches and unauthorized access attempts.

- Device Fingerprinting: By analyzing device-specific attributes, such as device type, location, and browsing behavior, device fingerprinting tools help detect suspicious device activities and block fraudulent transactions.

Conclusion: Staying Ahead of Emerging Threats

As fintech companies embrace technology for fraud prevention, they must also remain vigilant in staying ahead of emerging threats.

Fraudsters continually adapt their tactics to exploit vulnerabilities, making it imperative for fintech firms to evolve their security measures in tandem.

Regular updates, continuous monitoring, and proactive threat intelligence sharing within the industry are essential practices in the ongoing battle against payment frauds.

The fintech industry's ongoing growth and innovation bring both opportunities and challenges. While payment frauds pose a significant threat, the strategic implementation of advanced technology, coupled with specialized tools and services, empowers fintech companies to protect their systems and users effectively.

By staying at the forefront of technological advancements and collaborating to counter emerging threats, fintech firms can build a secure and trustworthy ecosystem for digital finance.

As we wrap up, remember the importance of robust fraud prevention measures in the fintech industry. Protecting your business and customers from payment fraud is not an option; it's necessary. Embrace these practices and proactively safeguard your fintech venture.

Ready to fortify your fintech business against payment fraud? Schedule a free demo today.

.jpeg)

.jpeg)