It is no secret that the banking sector in emerging countries is undergoing a significant transformation as as digital transformation reshapes traditional banking operations. This shift is not merely a response to technological advancement but a strategic adaptation to the increasing demands of consumers seeking more efficient and accessible financial services. In general, this evolution is driven by three main developments:

- Platforms: Digital platforms are emerging as centralized hubs offering a suite of banking services—including account management, loans, and investments—accessible from a single point. These platforms simplify customer interaction with the bank’s various services, enhancing user experience and operational efficiency.

- User Scenarios: In response to diverse customer needs, banks are tailoring their services to provide personalized experiences that align with the unique financial goals and circumstances of different customer segments. This approach not only improves service delivery but also helps in building stronger customer relationships.

- Scalability: To reach a broader audience, banks are scaling their operations through strategic partnerships with other companies, employing mass digital marketing campaigns, and initiating promotions. This scalability is crucial for tapping into new market segments and expanding their customer base beyond traditional boundaries.

While these advancements bring undeniable benefits in efficiency and customer satisfaction, they also introduce significant implications. The first is the complicated capital chain: The financial ecosystem now encompasses a wide range of players, including fintech startups, third-party technology providers, and non-financial companies offering complementary services. This expansion not only deepens the complexity of the capital chain—increasing the number of steps and participants in the flow of funds—but also amplifies potential vulnerabilities. As a result, it leads to an environment ripe for exploitation by fraudsters, who can launch coordinated attacks targeting multiple weak points across this extended network. These attacks typically spread quickly and discreetly, posing substantial risks to the integrity and security of financial operations.

In this rapidly evolving digital landscape, banks face the dual challenge of harnessing innovation to improve service delivery while simultaneously fortifying their defenses against an increasing array of cyber threats.

Challenges of Fraud Risk Management in the Digital Age

Traditionally, banks’ data such as customer information, transaction details and loan records were scattered across various separate systems and databases. This fragmentation made it difficult to access, manage, and utilize data effectively.There’re some recent developments through the tech advancement of data marts and data warehouses which have helped alleviate this issue, but challenges remain, such as lengthy data extraction processes, low computational capabilities, and a lack of efficient data management tools.

The rise of industrialized fraud groups has further complicated the data management challenges. These groups operate with high levels of organization and sophistication, using advanced techniques to carry out large-scale fraudulent activities. They can swiftly adopt new attack methods to bypass risk control strategies, while simultaneously targeting multiple financial institutions, makes them particularly challenging to combat.

Risk management in silo by product verticals and user scenarios are no longer sufficient. It’s more crucial now than ever to develop a comprehensive, cross-channel and cross-scenarios joint prevention and control system. When it comes to conventional banks with larger scale of business, an enterprise-level construction is needed. By integrating risk information and real-time business data across various operational areas, banks can create a coordinated defense strategy, enhancing their ability to detect and respond to fraud more effectively.

As demands on risk management grow, it has also led banks to prioritize the post-evaluation of their entire risk management systems. This includes assessing effectiveness, efficiency, and value. Continuous monitoring of outcomes, rule strategies, and model performance is essential to quickly identify and address any weaknesses in fraud defenses. Regular analysis and optimization of risk strategies, employing AI technology, ensure ongoing and adaptive protection against fraud.

Building an Intelligent Risk Control System Driven by Business Value

To address these challenges, banks need to create an intelligent risk control system aligned with their business objectives. This system should balance risk, security, and user experience, forming a robust framework with clear risk scenarios, measurable strategy effectiveness, optimized decision-making, actionable emergency responses, and efficient operational processes.

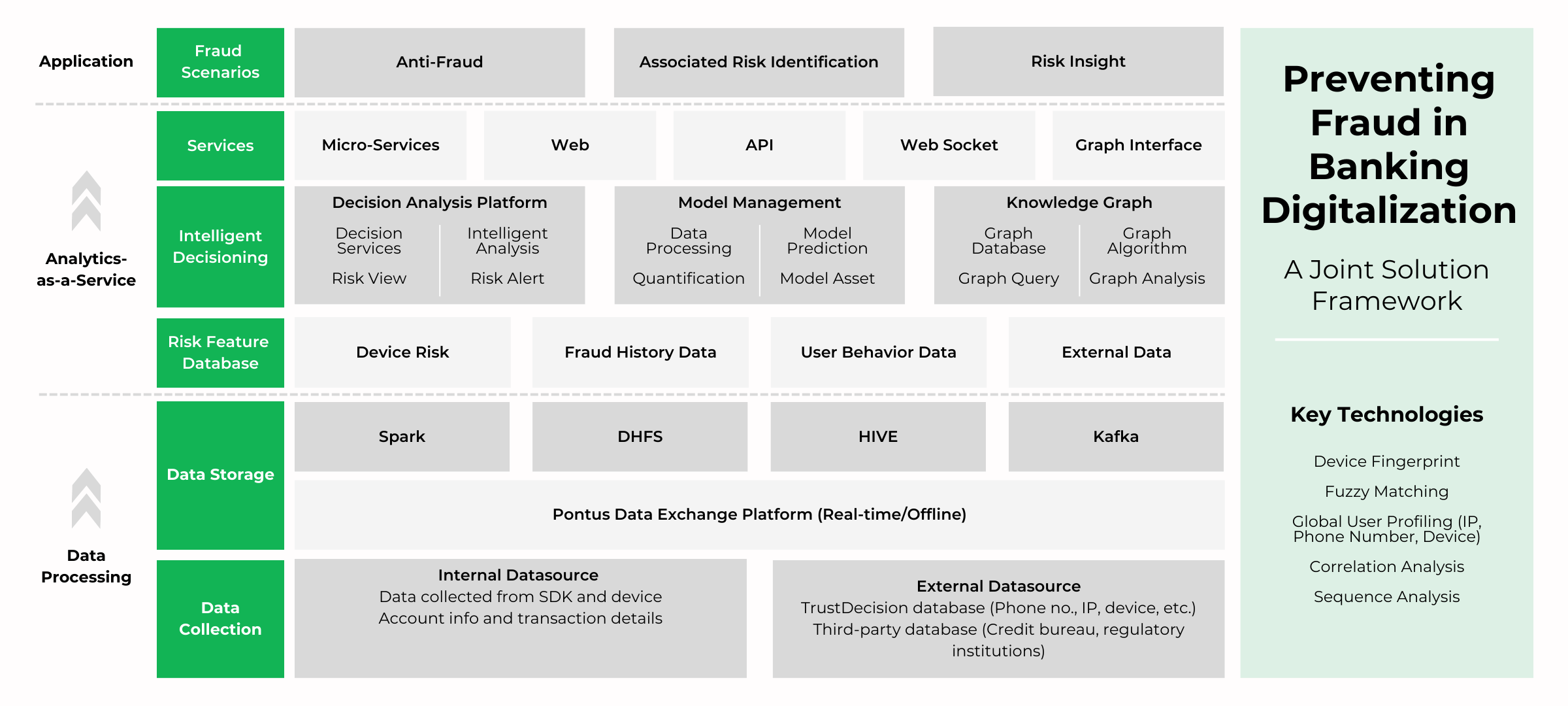

Financial institutions should integrate internal and external data resources to build a cross-industry, cross-scenario data system, which is crucial for real-time data sharing and application connectivity. . This integration enhances risk management efficiency and fosters multi-business collaboration. Developing a digital risk control ecosystem based on data marts, feature libraries, and data models ensures comprehensive coverage across all processes, channels, and scenarios. This approach enables banks to respond more effectively to risks and improve control measures.

Developing a complete customer profile and unified list allows more accurate risk assessment — a central support system with unified lists, labels, profiles, models and customer evaluations. Real-time monitoring of risk conditions, providing early warnings of potential risks, and measuring risk levels help build a closed-loop decision-making process, improving risk management effectiveness.

Key components of an intelligent risk control system include business channel access, external data integration, index derivation and support, unified data support, decision engines, model engines, and graph analysis engines. These elements work collaboratively to provide comprehensive risk control solutions. A quick-response intelligent decision engine is particularly critical, enabling financial institutions to effectively manage risks in high-volume, high-concurrency scenarios. By leveraging the decision engine, banks can swiftly formulate control strategies and decision models tailored to various scenarios, enhancing risk identification and response capabilities.

New Trends in Financial Risk Management

Reflecting on the evolution of banks, risk management has always been a core competitive strength. However, influenced by external economic and technological environments, risk management models have varied significantly over different periods. With the ongoing digital transformation of banks, several trends are emerging in the construction of risk control systems.

Financial institutions are striving to unify and standardize risk indicators to better execute optimal risk management. Through refined management processes and systems, they can achieve more efficient risk management. Although data integration capabilities and model-building technologies in risk control platforms are maturing, their application in different business scenarios still faces challenges. Risk control platforms, designed as microservice technology platforms, aim to offer innovative services on a large scale and improve customer response efficiency. Financial institutions need to address how to provide differentiated services across various business scenarios to overcome design differences in measurement, application, and experience layers.

The application of digital technologies such as AI and big data analytics is enhancing early risk identification capabilities, moving risk management processes forward. Various risk management processes, including credit, market, operational, and liquidity risk management, are shifting to the front end. These technologies provide more comprehensive and accurate risk assessment tools, helping financial institutions address various risk challenges while achieving a business, cost, and risk integrated development model.

By embracing these trends and innovations, banks in emerging countries can navigate the complex landscape of digital transformation and regulatory compliance, ensuring robust and effective risk management in an increasingly digital world.