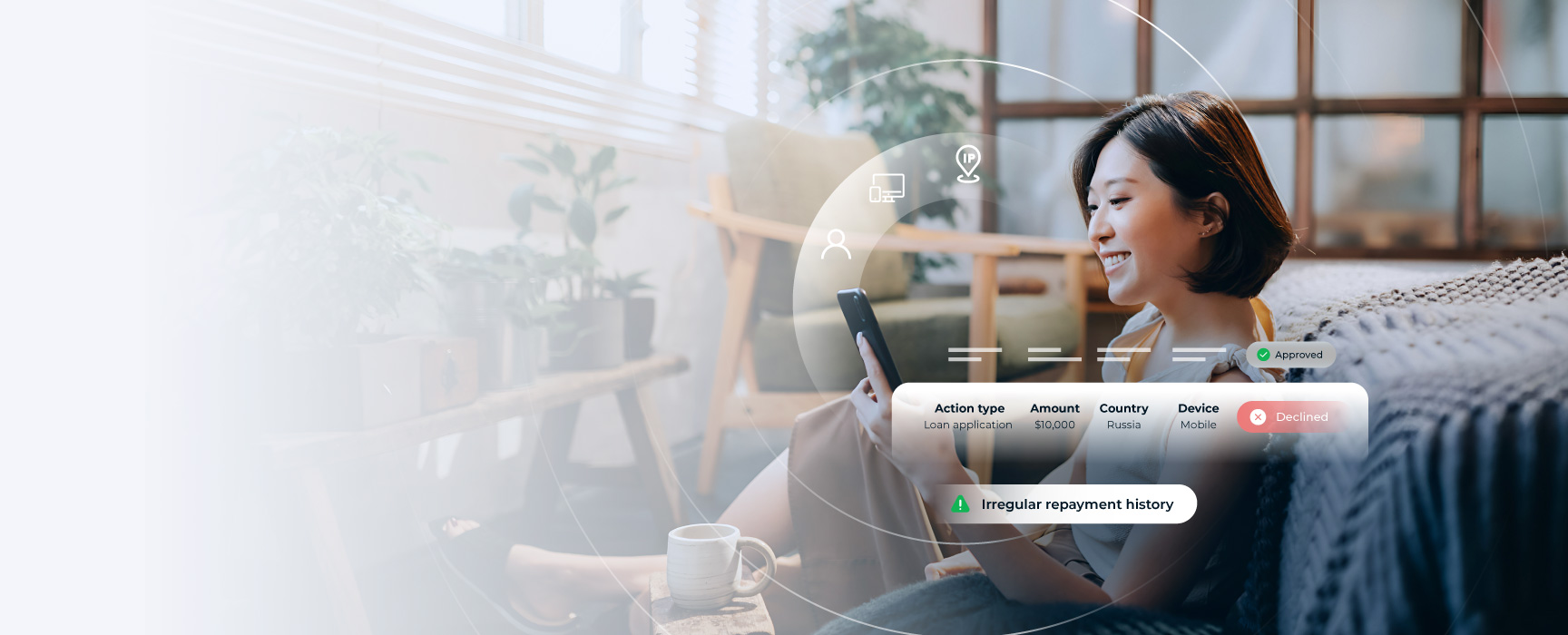

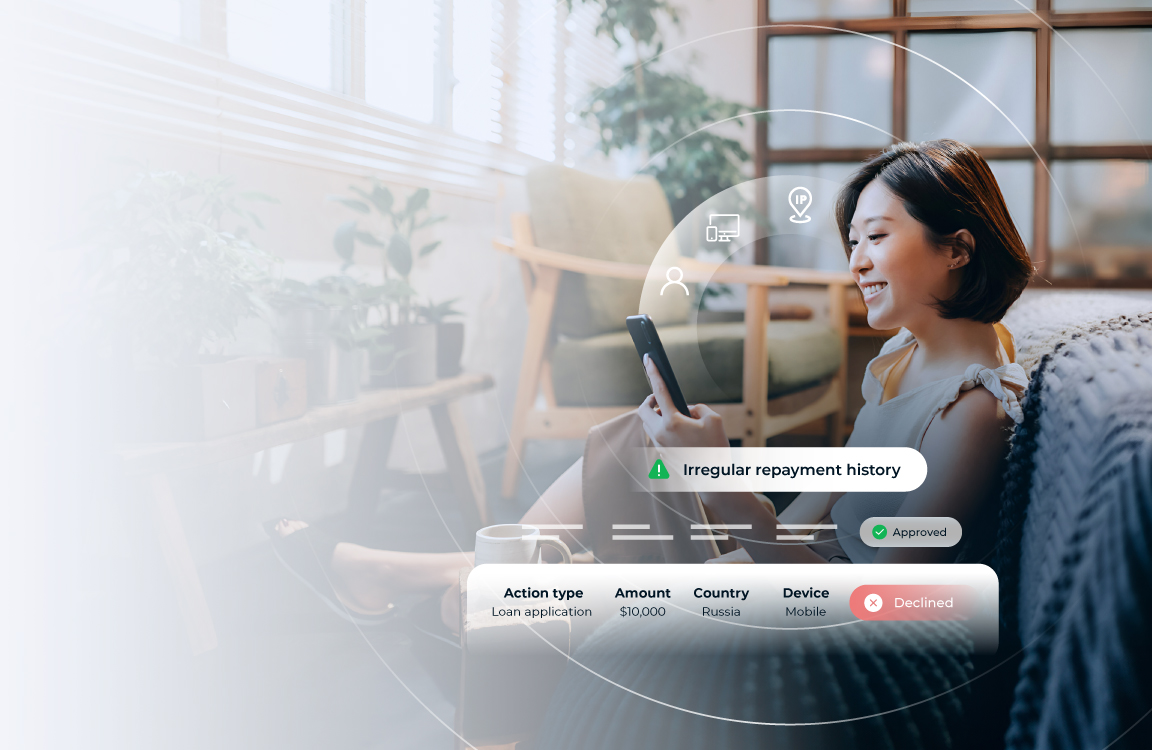

Protect every stage of the loan journey—from registration to disbursement—by stopping synthetic identities, fake applications, and fraud rings early.

Combine signals from user identity, device fingerprinting, and behavioral patterns to flag high-risk borrowers, and block complex fraud tactics.

Our system learns every new fraud pattern, updating blocklists and fine-tuning strategies automatically in real time.

Protect every step of the lending journey, from registration to disbursement—with continuous risk screening

It helps detect fake registration, identity fraud and blocks loan stacking through real-time risk assessment. This lowers financial losses due to fraud and increases operational efficiency.

The multi-layered defense system can reduce false positives, which results in better customer experience where genuine applicants can go through the process smoothly without unnecessary interruptions. This approach is particularly beneficial for industries such as digital lending and other financial services, where accurate fraud detection is essential for maintaining trust and security.

A cross-referencing analysis of email and phone verification, device intelligence and behavioral analytics can aid in verifying legitimacy of contact details, detecting multi-account creation, and differentiating between real-users/bots/fraudsters.

Machine learning models can analyze vast amount of data, adapt to evolving fraud techniques and enable proactive fraud detection. Our knowledge graph helps to connect various data points (email, phone numbers and device) to build a comprehensive user profile.

Real-time decisioning that continuously monitors applicants' actions and makes instant decisions with anomalies can help to stop fraud in time.

Unlike a generic, one-size-fits-all approach to tackle fraud, which often falls short, we specifically design its anti-fraud strategy for digital lenders, addressing the complexities of the loan application process.

The solution connects multiple datapoints — email, phone number, device, and user behaviors—using a knowledge graph to identify complex fraud schemes.

Additionally, alternative credit data can also be incorporated to assess applicants more holistically, even those with limited traditional credit histories.

With over a decade of anti-fraud expertise, our application fraud detection solution adapts dynamically to evolving fraud tactics by using accumulated background data, authoritative data sources, and advanced analytics. Leveraging real-time risk scoring, behavior analysis, and device fingerprinting, it detects synthetic identities, bot-driven submissions, and suspicious patterns. This comprehensive approach protects against sophisticated fraud, ensuring a secure and seamless application process.

Let’s chat about your needs, we’ll find you a solution and give you a walkthrough of what we can help you with.