Nearly 90% of Lenders Use AI to Stop Fraud at Onboarding

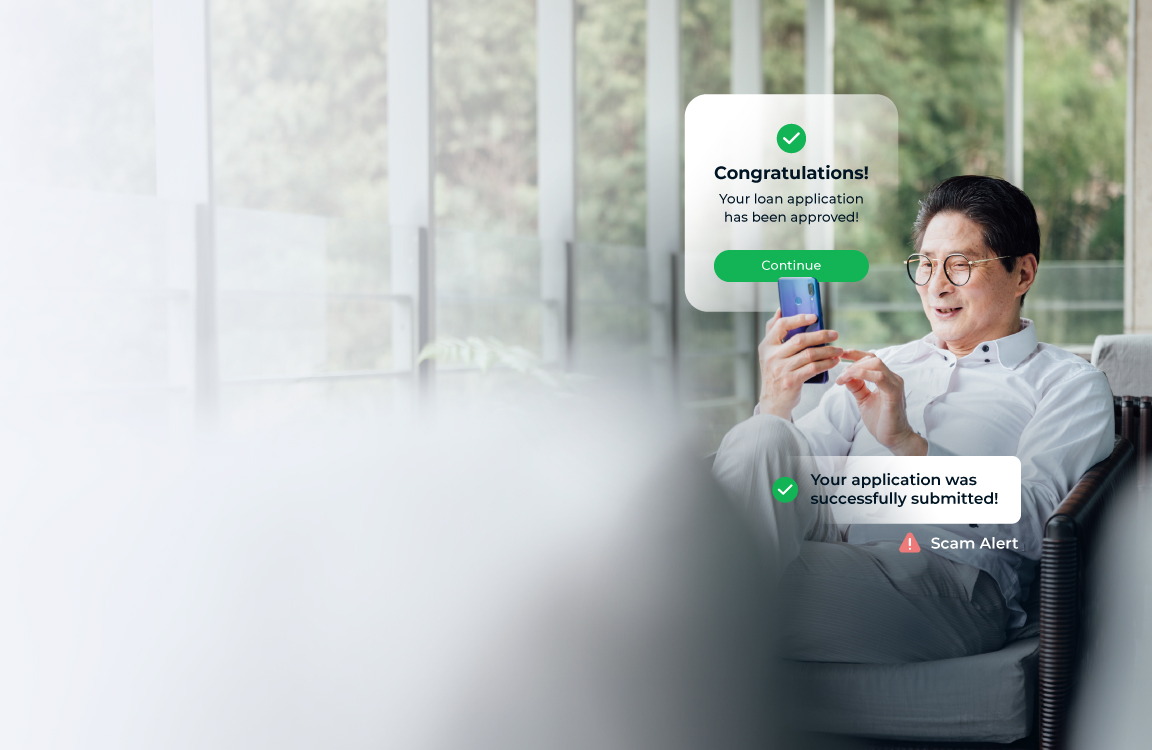

Fraudsters exploit the speed of digital onboarding with stolen IDs, forged documents, and even AI-generated deepfakes. Once approved, they vanish with loan funds.

Fraudsters exploit the speed of digital onboarding with stolen IDs, forged documents, and even AI-generated deepfakes. Once approved, they vanish with loan funds.

Relying solely on bureau data blinds lenders to untapped potential and leaves thin-file or new-to-credit borrowers excluded.

Borrower risk is fluid—life events and market shifts can quickly change repayment ability. Without continuous monitoring, issues escalate into delinquencies.

Through ATO and social engineering, fraudsters exploit data gaps across lenders to take multiple loans before systems update—causing duplicate disbursements and defaults.

TrustDecision helps lenders manage both fraud and credit risk in one platform—from onboarding and eligibility checks to disbursement and repayment. Detect fake applicants, prevent default, and make confident lending decisions at scale.

TrustDecision offers a comprehensive fraud management solution, integrating AI-powered tools to safeguard banking and lending platforms from evolving fraud risks. Each solution provides unique capabilities to address specific vulnerabilities in the customer journey.

Together, these solutions offer an integrated approach to fraud prevention, ensuring security, compliance, and trust while enabling banks to operate confidently in an increasingly complex threat landscape.

Application Fraud Detection employs a multi-layered approach to prevent fraudulent loan applications effectively:

This comprehensive strategy minimizes fraud risks, safeguards lenders, and ensures seamless services for genuine users.

Learn more about Application Fraud Detection.

TrustDecision provides non-traditional data sources, such as digital and social media presence, data breached history, loan application activity and repayment behaviour across multiple online lending platforms, and device risk insights to assess creditworthiness accurately.

These alternative credit data insights give digital banks or online lending platforms more confidence in issuing loans to unbanked/underserved customers. The easy API / SDK integration of Identity Verification, KYC++, and Application Fraud Detection also helps businesses enhance security and keep the system up-to-date with the latest fraud trends and technologies.

TrustDecision simplifies KYC compliance by leveraging AI-driven solutions that meet the top KYC requirements across APAC:

This streamlined compliance processes, helps digital banks to reduce administrative burdens and costs, minimize regulatory risks, and enhance operational efficiency.

TrustDecision offers a comprehensive, end-to-end fraud management system that safeguards every stage of the customer journey, from registration and login to online transactions. Key features include:

TrustDecision's adaptive AI and customizable fraud prevention strategies help the banking and lending industry prevent fraud, ensure compliance, build customer trust, and improve operational efficiency.

Let’s discuss your goals—whether it’s reducing fraud losses, improving credit approvals, or scaling risk management.