The digital banking landscape in the APAC region has been rapidly transforming, with digital banks emerging as key players in the financial sector.

Concurrently, super-apps — multi-service platforms that offer a range of services from ride-hailing to e-commerce — are increasingly entering the banking space. This convergence is reshaping the financial ecosystem across APAC. In countries like Indonesia, the Philippines, and China, super-apps like Grab, Gojek, and WeChat are evolving to provide banking services, while traditional banks are also expanding their digital capabilities to become more like super-apps, offering services like repaid recharge and online shopping. The integration of these two entities holds significant potential for enhancing financial inclusion, accelerating market growth, and driving innovation.

Digital Banking: The Trend of Embracing Mobile Services

Super-apps are digital platforms that offer a multitude of services within a single application, serving as digital hubs for users. Examples include Grab and Gojek in Southeast Asia, and WeChat and Alipay in China. These platforms have evolved beyond their original services — such as ride-hailing or messaging — to include food delivery, e-commerce, payments, and more. Their role as one-stop digital ecosystems makes them incredibly valuable, offering a seamless experience to a vast user base.

Why Digital Banks Expand Their Digital Services

For digital banks, super-apps present an unparalleled opportunity to access a large, engaged user base. Developing an ecosystem with more life-style services to increase user acquisition and user stickiness.

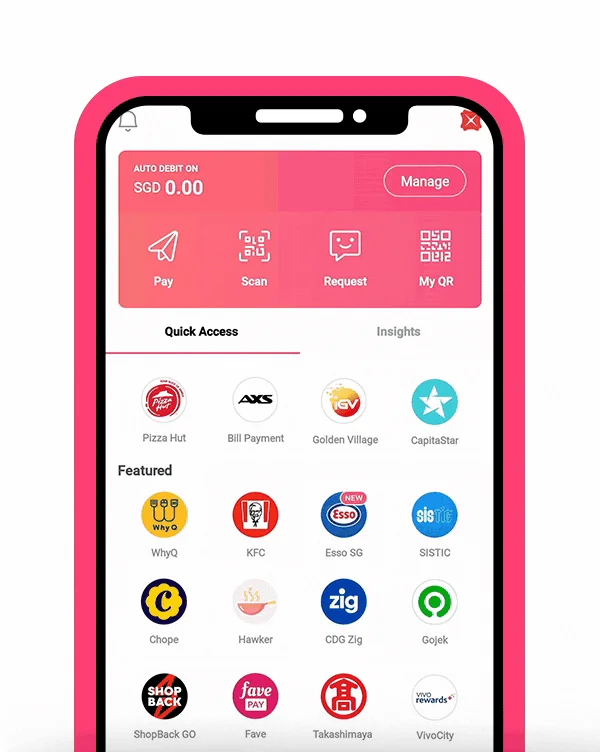

Taking DBS Bank’s e-wallet app DBS PayLah! as an example. DBS Bank in Singapore has transformed its app into a super-app by expanding its services far beyond traditional banking. Initially focusing on core banking functions like account management, loans, and credit cards, the DBS app has evolved to include a wide range of financial services. It now supports peer-to-peer payments, bill payments, and QR code transactions, making daily financial tasks more convenient. The app also offers investment services, including stock trading and robo-advisory tools, alongside various insurance products.

To enhance user experience, DBS integrates lifestyle services such as exclusive deals and financial planning tools within the app. The seamless, unified interface provides real-time alerts, personalized financial insights, and robust security features, effectively making DBS PayLah! a comprehensive platform for managing both financial and lifestyle needs.

Super-Apps: The Strategic Partnership with Digital Banks

As super apps expand their service offerings, many are turning to strategic partnerships with digital banks to enhance their financial capabilities. These collaborations provide significant advantages, from faster market entry and streamlined regulatory compliance to improved risk management and increased user trust.

Accelerating Market Entry and Navigating Regulations

Partnering with digital banks allows super apps to quickly offer a broad range of financial services without the lengthy process of developing these capabilities internally. Digital banks provide the necessary regulatory frameworks and licenses, enabling super apps to enter new markets swiftly and efficiently while avoiding complex compliance challenges.

Leveraging Expertise for Better Risk Management

Financial services require specialized expertise, particularly in risk management for lending and credit. Digital banks bring this expertise, offering established systems to assess creditworthiness and manage financial risks. This partnership helps super apps reduce their exposure to financial risks and ensures a more stable, secure financial service offering.

Enhancing Trust and Credibility

Financial services require a high level of user trust, often more than other services offered by super apps. Collaborations with well-regarded digital banks enhance credibility, as users are more likely to trust financial products backed by a regulated institution. This trust can boost the adoption of financial services within the super app’s ecosystem.

By joining forces, super apps and digital banks leverage each other's strengths, enabling them to deliver comprehensive financial services more efficiently while focusing on their core competencies. A prime example of this strategic partnership can be seen with Gojek, which has collaborated with Bank Jago, a digital bank. This partnership allows Gojek to integrate a range of banking services directly into its platform, enhancing its financial offerings and providing a seamless user experience, all while benefiting from the banking expertise and regulatory compliance of its partner.

Driving Financial Inclusion in APAC

The integration of super-apps and digital banks in the APAC region addresses deep-rooted financial inclusion challenges by combining their unique capabilities to reach underserved communities effectively.

Super-apps, like Gojek and Grab, already operate as central digital hubs for millions, providing a convenient platform for users who may lack access to traditional banking infrastructure. When these super-apps incorporate digital banking services, they capitalize on their existing user base and high engagement levels to deliver financial products directly to users who are often excluded from the formal financial system due to geographic, economic, or social barriers.

Digital banks, which often operate with lower costs and fewer regulatory burdens than traditional banks, leverage this partnership to expand their reach into rural and semi-urban areas, offering tailored financial solutions such as microloans, digital wallets, and savings plans that cater specifically to the unbanked or underbanked. This collaboration not only facilitates easier access to essential financial services but also promotes financial literacy by integrating financial tools into everyday digital experiences, thereby fostering a more inclusive financial ecosystem that aligns with regional socio-economic goals.

The Future of Digital Ecosystems in APAC

Trends in Digital Banking and Super-app Integration

As the integration of digital banks and super-apps continues to evolve, several key trends are emerging in the APAC region. One notable trend is the development of co-branded financial products, such as digital wallets, credit cards, and savings accounts, that combine the strengths of both entities. Some super-apps and digital banks are even forming joint ventures or strategic alliances to better serve their customers and create synergies.

The rise of ”Banking-as-a-Service” (BaaS) models is another significant trend, allowing digital banks to provide their infrastructure and technology to non-banking companies. This approach enables super-apps to offer financial services under their own brand without having to build the complex infrastructure required for banking.

Potential Challenges and Considerations

While the integration of super-apps and digital banks offers many benefits, it also presents several challenges that need to be carefully navigated. Regulatory compliance remains a major concern, as financial services are heavily regulated across most countries in the APAC region. Super-apps and digital banks must work closely together to ensure that all services are offered in compliance with local regulations and laws.

Data privacy and security are also critical considerations, given the sensitive nature of financial transactions and personal information. Maintaining robust data protection measures and transparent practices will be crucial for sustaining user trust.

Additionally, the growing competition and potential market saturation pose risks. As more players enter the market, differentiation and continuous innovation will be essential for maintaining a competitive edge.

Looking forward, the relationship between super-apps and digital banks in the APAC region is likely to grow even stronger. The demand for more integrated, seamless digital experiences will continue to drive partnerships, leading to more innovative products and services. Co-branded financial products, deeper integration of services, and new business models that blend digital and financial services will become more prevalent. This evolving landscape will foster a more inclusive and innovative financial ecosystem, helping to bridge gaps in financial access and support economic growth across the region.