In the competitive realm of e-commerce, merchants face a relentless battle against chargebacks and refund frauds, particularly in cross-border transactions. To navigate this minefield, a solid strategy is essential – not just to stay alert but to actively protect the business from significant financial loss. In such situations, the chargeback guarantee service appears as a safety net, promising reimbursement for any fraudulent transactions. But, is the chargeback guarantee the ultimate solution for risk control?

To grasp the model better, let’s understand why companies opt for this approach in the first place:

- Navigating risk in business expansion: When businesses expand, especially into new markets, they encounter complex risk challenges. Many lack in-depth expertise in this area, making the chargeback guarantee model a preferred choice. It offers a straightforward way to minimize financial losses without needing extensive knowledge in managing it

- Operational efficiency and resources optimization: Some companies view the chargeback guarantee service as a way to streamline operations and reduce the need of manually handling disputes, reconciling transactions, and managing cancellations. This approach aims to address potential operational challenges and improve overall efficiency.

Nevertheless, with the business and fraud landscape becoming more sophisticated, there is no one-size-fits-all strategy. While the chargeback model presents clear benefits, it’s important to remain vigilant about potential risks and limitations — be mindful of the risks that could impede business ventures.

In-app purchases may not be covered in chargeback guarantee model

In-app purchases / in-app payments are prevalent in gaming and entertainment transactions, often processed through Apple Pay or Google Pay. This has present a unique challenge unlike the credit card payment methods, these payment methods may not specify reasons for refunds, blurring the line between legitimate and fraudulent refund claims.

Consequently, losses from in-app purchases are typically not included in the compensation offered by third-party risk control service providers. The refund rate for these channels may also be higher than other payment methods, resulting merchants to bear the high losses by themselves.

3DS-Verified transactions are beyond the scope of chargeback guarantees

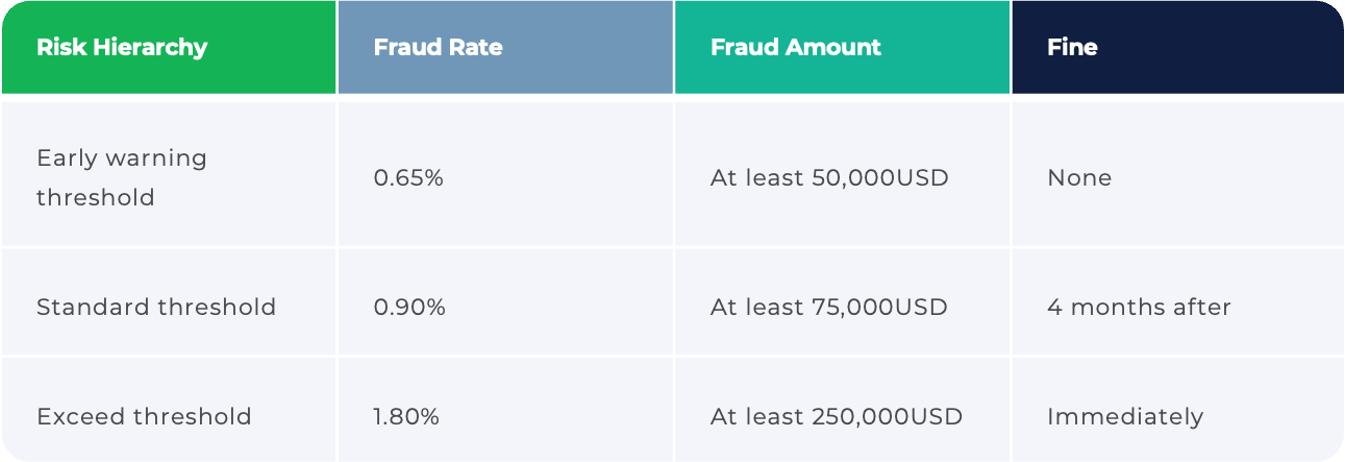

For safety reasons, a 3DS verification for cross-border payment is mandatory in certain countries like Singapore, Malaysia, South Africa, Nigeria, etc. While this process shifts fraud liability to the card issuer for verified transactions, it's important to note that these transactions are generally not included in chargeback guarantee protections. Additionally, no security measure is infallible; even with 3DS, data breaches can provide fraudsters with loopholes to exploit. Payment networks like Visa and Mastercard have been monitoring the merchant’s fraud rate closely. Taking the Visa Fraud Monitoring Program (VFMP) as an example, the fraud rate monitoring requirements for transactions verified through 3DS are as follows:

Therefore, chargeback guarantees do not fully mitigate the risks tied to 3DS channel transactions. If fraud rates exceeds the threshold for 3DS, merchants may find themselves back at square one, reassuming liabilities they thought were covered. Worse yet, excessive fraud rates can trigger stringent penalties ranging from hefty fines to the potential shutdown of crucial payment channels.

Getting risk management right for e-commerce merchants

While the chargeback guarantee model does shoulder fraud-related financial losses to a certain extend and promised payment success rate, it might also lead to an increase of fraud rate and chargeback rate. Such an uptick often prompts card issuers and banks to heighten their monitoring, which can affect merchants’ future transaction approval rate.

The crucial question remains…

Should cross-border e-commerce merchants adopt a chargeback guarantee model as their risk management strategy?

Choosing a capable risk control provider is vital for e-commerce businesses to comprehensively manage risk, thereby enhances the financial stability and resilience of the company. Within a spectrum of fraud prevention solutions, the chargeback guarantee stands as just one of the options. When vetting through a risk control solution provider, it’s crucial to weigh out these few factors:

1. Proven expertise

Seek out for providers with a track record of effectiveness, has a team of subject matter experts with extensive experiences across various industries and a solid history of combating fraud successfully.

2. Technological agility

Technological agility

Choose a risk control service provider that utilizes advanced technology for real-time fraud detection and adaptive responses to the rapidly changing risk environment. Features to look for include a robust decision engine, excellent device fingerprinting, and the use of big data analytics for deep insights into transaction patterns.

3. Regulatory compliance

It’s essential to partner with a third-party risk control provider that adheres to pertinent regulations such as General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Certifications like ISO27001, PCI-DSS, and SOC2 are also crucial as they reflect adherence to stringent security standards.

4. Comprehensive support

Evaluate the extent of customer support, including strategy model updates, risk alerts, technical support, product training and after-sales services. A good solution provider should have the capability to tailor risk strategies to different business use case and have the flexibility to adjust the model in real-time in response to emerging threats.

5. Value for money

Analyze the cost-effectiveness of the service. The ideal provider should offer a favorable balance between affordability and the quality of their risk management solutions. The goal is to ensure a return of investment (ROI) through robust fraud prevention mechanism that support sustainable business growth.

In a nutshell,

While the chargeback guarantee model offers certain protections and can be part of a robust risk management strategy, it is not a standalone solution for the complexities of e-commerce fraud. Merchants must look beyond this single feature and consider a provider's overall expertise, technological capability, regulatory compliance, customer support, and cost-effectiveness. By taking a holistic view of risk management and choosing a service that aligns with these critical factors, e-commerce businesses can build a more resilient defense against the evolving threats of the digital marketplace.

It's about finding the right partner to navigate the challenges, one that can adapt to the unique needs of your business and provide a safety net that allows for growth with security.

About TrustDecision

A global SaaS risk management platform that has served businesses in over 150 countries across diverse industries (banking, fin-tech, retail, e-commerce, travel, gaming, etc.). Supported by domain experts with a more than 10 years of experience in this field with high proficiency in managing all kinds of risks such as transaction, payment marketing, credit, etc.

It leverages AI-driven decision engine with the best device fingerprint, identity verification to differentiate genuine users, transaction monitoring to detect anomalies through machine learning and knowledge graphs to identify fraud gang. All of these while ensuring adherence to global data protection regulations.

.jpeg)

.jpeg)