Keypoints

- AI dramatically improves risk assessment accuracy in BNPL credit decisioning through real-time analytics and alternative data.

- AI-driven models reduce default rates and optimize loan portfolio performance by dynamic segmentation and continuous learning.

- Explainable AI ensures transparency and regulatory compliance, balancing innovation with ethics.

- AI enables faster, automated underwriting while adapting portfolios to new market conditions.

- Integrating AI in BNPL helps drive operational efficiency, customer satisfaction, and sustainable growth.

Introduction: The BNPL Revolution and AI Imperative

Buy-Now-Pay-Later (BNPL) is rapidly transforming digital commerce, with global BNPL payment volumes set to reach USD 560.1 billion in 2025 (13.7% year-over-year increase) and forecasted to approach USD 912 billion by 2030.

As BNPL becomes mainstream, lenders face a critical challenge: delivering instant approvals while maintaining robust risk controls.

The Consumer Financial Protection Bureau (CFPB) has intensified scrutiny on BNPL providers, requiring enhanced risk management, while customer expectations for seamless experiences continue driving competitive pressure. Traditional underwriting systems cannot meet BNPL's instant decisioning requirements with minimal credit history data.

Advanced AI technologies have emerged as the solution, delivering real-time credit decisioning, smarter fraud detection, dynamic risk scoring, and scalable portfolio management that enables BNPL providers to balance rapid growth with financial resilience.

In this article, we explore how AI-driven credit decisioning is essential for BNPL providers aiming to balance growth with financial resilience.

Understanding the BNPL Credit Decisioning Landscape

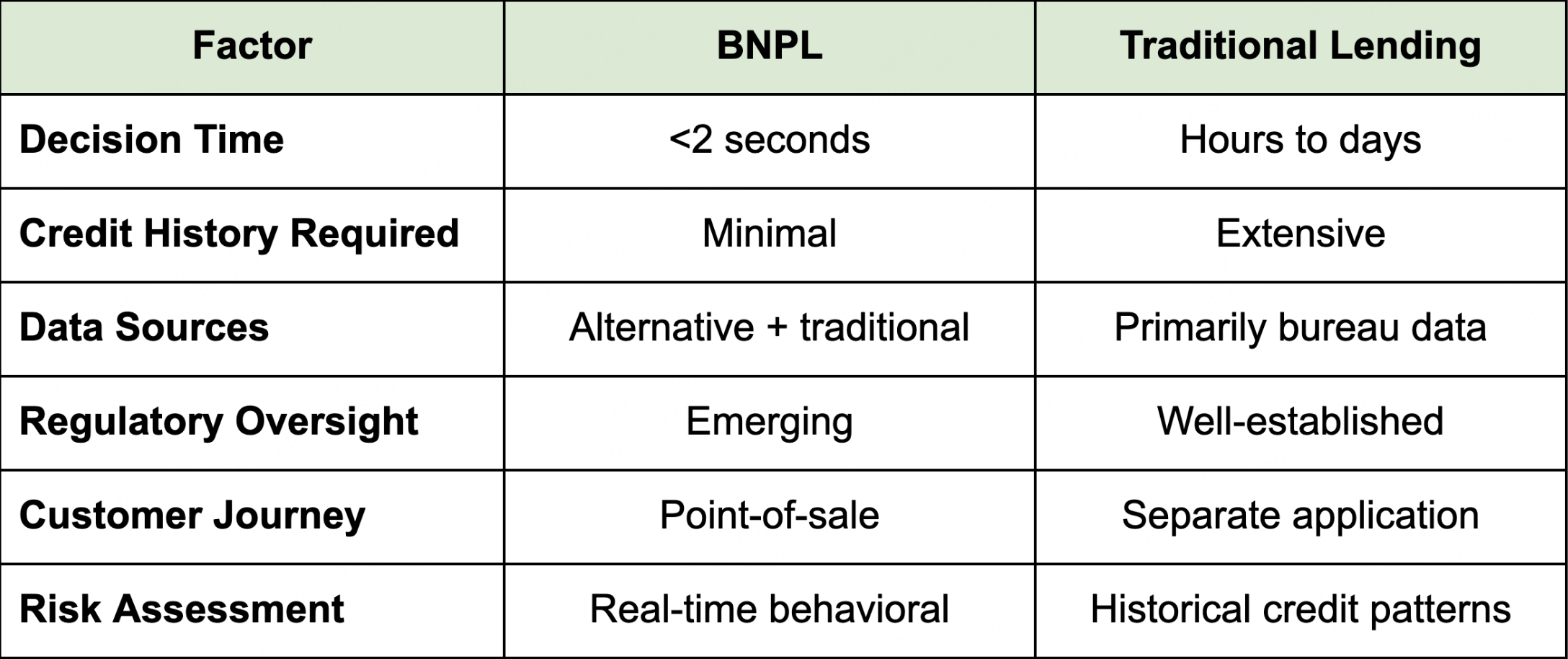

What Is BNPL Credit Decisioning, How Is It Different from Traditional Lending?

BNPL credit decisioning is the process of assessing a customer's creditworthiness and determining loan approval in real-time at the point of purchase. This differs fundamentally from conventional lending, which relies on extensive documentation and lengthy approval processes.

What Makes BNPL Credit Assessment Uniquely Challenging?

BNPL operates under extreme time constraints. Decisions must be made in under 2 seconds to avoid disrupting the shopping experience. Unlike conventional lenders who have days or weeks to evaluate applications, BNPL providers must instantly assess risk with limited customer data, often serving younger demographics with minimal credit histories.

BNPL vs Traditional Lending Comparison:

This matrix compares rule-based vs AI-driven risk decisioning across key dimensions: accuracy, processing speed, fraud detection, and adaptability.

Core BNPL Decisioning Challenges:

- Instant approvals required at checkout without disrupting customer experience

- Thin credit files or limited credit histories for younger customer segments

- Loan stacking risk across multiple BNPL platforms leading to overextension

- Silent defaults where customers stop paying without formal notification

These constraints require fundamentally different approaches to credit risk assessment compared to traditional lending models, making AI-driven solutions essential for competitive BNPL operations.

The Institutional BNPL Challenge: Why Legacy Systems Fail

Legacy credit decisioning systems rely on static rule-based frameworks that cannot adapt to BNPL's dynamic requirements. Key limitations include:

- High false positive rates (15-25%) leading to significant cart abandonment and lost revenue

- Manual review delays that disrupt the checkout experience

- Rigid credit bureau dependencies that exclude thin-file customers representing BNPL's core demographic

- Growth vs. risk trade-offs forcing providers to compromise between expansion and portfolio quality

Customer Impact: Every declined transaction represents lost immediate revenue and potential permanent customer loss to competitors. Research shows cart abandonment rates exceed 70% when customers face payment friction, with many never returning to complete their purchase.

AI-driven systems eliminate these compromises by delivering real-time, adaptive decisioning that maintains both growth and risk discipline.

What Market Dynamics Are Driving AI Adoption in BNPL?

Multiple pressures are making AI adoption essential for sustainable BNPL operations:

- Competitive Pressures:

- Fintech disruptors demanding higher approval rates without compromising portfolio quality

- Merchant partnerships requiring 85%+ approval rates for qualified transactions

- Need for improved customer acquisition costs and merchant satisfaction scores

- Regulatory and Economic Factors:

- CFPB and international regulatory scrutiny requiring enhanced risk management capabilities

- Economic uncertainty demanding adaptive models that respond to changing market conditions

- Competitive Advantage:

- Early AI adopters demonstrate superior portfolio performance metrics, improved customer acquisition costs, and access to more favorable funding terms compared to those relying on traditional methods.

- This makes AI adoption essential rather than optional for market leadership.

How AI Technologies Transform BNPL Risk Assessment

How Does AI Improve Risk Assessment Accuracy in BNPL Credit Decisioning?

Modern BNPL platforms leverage multiple AI architectures optimized for different aspects of credit decisioning:

Machine Learning Models for Real-Time Decisions:

- Gradient Boosting Models (XGBoost, LightGBM) - Process structured financial data with 90%+ accuracy and sub-200ms inference times

- Neural Networks - Handle complex pattern recognition across unstructured data, processing device fingerprinting, clickstream patterns, and transaction sequences simultaneously

- Ensemble Methods - Combine multiple algorithms for optimal accuracy-speed balance, achieving 15-25% better performance than single-model implementations

Explainable AI for Decision Transparency:

- SHAP (Shapley Additive Explanations) - Shows how individual factors like credit utilization influenced approval decisions

- LIME (Local Interpretable Model-Agnostic Explanations) - Provides case-by-case decision explanations for regulatory compliance

- Feature Impact Analysis - Quantifies each data point's contribution to final credit decisions

- Automated Compliance Documentation - Creates audit trails demonstrating fair lending practices

- Consumer-Friendly Explanations - Translates complex AI decisions into clear, understandable language

How Much Better Does AI-based BNPL Perform Than Traditional Systems?

Performance Benchmarks:

- Sub-50ms inference times during peak periods

- 92-96% accuracy vs 78-85% for traditional systems

- False positive rates reduced from 15-25% to 3-8%

- 15-25% performance improvement translates directly to revenue gains

These improvements deliver higher approval rates, reduced operational costs, and built-in system redundancy for reliability during high-traffic periods.

For comprehensive implementation guidance, explore TrustDecision’s Credit Risk Decisioning platform and Application Fraud Detection solutions.

Alternative Data Integration: Beyond Traditional Credit Scores

While AI algorithms provide the computational power for rapid decision-making, their effectiveness depends heavily on the quality and diversity of input data—which is where alternative data sources become critical for BNPL success.

AI-powered BNPL systems analyze unconventional data sources to build richer borrower profiles beyond traditional credit bureau information:

- Digital footprint analysis - Email consistency patterns, device usage history, and account tenure across platforms to assess identity stability and fraud risk

- Behavioral signals - Browsing patterns, app usage frequency, device switching behaviors, and session characteristics indicating user authenticity and financial stability

- Transaction context analysis - Merchant categories, purchase timing, cart composition, and seasonal behaviors to predict repayment likelihood (e.g., essential vs luxury purchases)

- Social and demographic indicators - Privacy-compliant frameworks extract risk-relevant signals for thin-file customers lacking traditional credit histories

- Data fusion techniques - Weighted ensemble models automatically adjust feature importance based on predictive performance, enabling continuous improvement as new data sources become available

Machine learning models trained on millions of transaction outcomes identify subtle patterns invisible to human analysts, particularly benefiting customers with limited credit bureau data.

Learn more about alternative credit scoring approaches that enhance financial inclusion while maintaining risk discipline.

Real-Time Processing Architecture for Instant Decisions

Modern BNPL platforms require sophisticated infrastructure to deliver sub-second credit decisions:

- Streaming Analytics - Event-driven architectures using Apache Kafka enable sub-second decision-making across distributed systems within strict latency constraints

- Edge Computing - Risk models deployed closer to point-of-sale interactions reduce network latency and improve reliability during high-traffic periods

- Container-Based Deployment - Enables rapid scaling and seamless model updates without service interruption

- API Gateway Optimization - Intelligent routing, request queuing, and fallback mechanisms ensure consistent performance during peak shopping events like Black Friday

- Advanced Caching - Frequently accessed data points are cached to further reduce processing times

- Failover and Redundancy - Multi-region deployments, automated health monitoring, and graceful degradation protocols maintain service availability during infrastructure issues

These systems typically achieve 99.9%+ uptime requirements critical for maintaining merchant relationships and customer trust during peak shopping periods.

The advanced AI infrastructure translates directly into measurable business outcomes that drive BNPL profitability and growth.

Suggested Flowchart: Step-by-step flowchart: Data Collection → Feature Processing → Model Scoring → Fraud Check → Final Decision, with feedback loops to retraining.

Business Impact: How AI Drives Superior Portfolio Outcomes

AI implementation in BNPL credit decisioning delivers measurable improvements across key performance indicators:

- Default rate reduction - 15-30% within the first year of implementation

- Approval rate optimization - 10-25% increases in qualified approvals without corresponding risk increases

- False positive reduction - 40-60% decreases in incorrect declines that damage customer relationships

- Customer lifetime value - 20-35% improvements through better risk segmentation and personalized credit offers

- Portfolio risk-adjusted returns - 5-15% profitability increases through dynamic pricing strategies

For a BNPL provider processing $100M annually, a 15% approval rate improvement can generate $10-15M additional revenue while reducing customer acquisition costs through improved experiences.

Advanced Risk Segmentation and Default Reduction

Smart AI models leverage advanced segmentation by clustering borrowers based on transaction behavior, repayment history, and soft digital signals rather than static demographics. This dynamic approach significantly boosts predictive performance:

- Early warning detection - AI identifies signs like late payments or erratic usage, proactively adjusting credit exposure limits to mitigate risk

- Real-time limit adjustments responding to changing customer behaviors and external risk factors

- Automated intervention strategies including personalized payment reminders and alternative arrangements

- Targeted customer profiling - With 42% of Millennials and Gen Z as active BNPL users (J.D. Power), AI-driven profiling fills critical data gaps for younger borrowers traditionally unseen by credit bureaus

These personalized approaches typically achieve 20-30% better recovery rates than traditional one-size-fits-all methods.

Operational Efficiency and Strategic Advantages

- Faster Decisioning and Enhanced Approval Rates: AI-powered underwriting systems operate at point-of-sale, analyzing borrower profiles in milliseconds. The outcome: higher approval rates, reduced cart abandonment, and streamlined customer experiences without sacrificing risk rigor.

- Cost Efficiency and Operational Resilience:

- Automated AI models reduce reliance on manual reviews and lower fraud-related losses

- Self-learning systems continuously adjust to data trends, resulting in fewer model maintenance cycles

- Stronger portfolio performance over time through continuous optimization

Real-World Applications & Case Studies: Industry Leaders AI Success Stories in BNPL

Market leaders Affirm and PayPal demonstrate that AI-driven BNPL credit decisioning delivers measurable competitive advantages across three critical dimensions: customer experience, operational efficiency, and portfolio performance.

Affirm: ML Excellence

Affirm deploys sophisticated machine learning that processes over 1 billion data points (from Meritech Capital. (Nov, 2020). Affirm IPO | S-1 Breakdown) daily for real-time credit decisions. Their system combines gradient boosting models with deep learning networks, achieving sub-100ms inference times for 99.9% of decisions.

Key Business Outcomes:

- 26% increase in cart conversion rates through dynamic payment schedules. (Payments Journal. (June 2023). Affirm Looks to Bolster Global Growth with WorldPay

Partnership) - 22% improvement in approval rates for qualified customers. (Payments Journal. (Ibid.)

- 30% reduction in default rates compared to traditional scoring methods. (Affirm Inc., (2023). Shareholder Letter and Investor Commentary)

- $2.3B+ in gross merchandise volume enabled through AI decisioning. (Meritech Capital. (Nov, 2020). Affirm IPO | S-1 Breakdown)

Affirm's success demonstrates how comprehensive data infrastructure and continuous model improvement based on actual portfolio performance can drive substantial business growth.

PayPal Pay in 4: Enterprise-Scale AI Implementation

PayPal's Pay in 4 leverages existing fraud detection infrastructure while adding BNPL-specific risk models, processing thousands of decisions per second during peak periods with 99.99% uptime across global markets.

Key Business Outcomes:

- 40+ million unique users had used its BNPL, up ~30% YoY (Coin Law. (June, 2025). PayPal Statistics 2025: A Deep Dive into Global Revenue, Users, and Transaction Volume)

- 7 out of 10 merchants in the US offer BNPL option (Ibid)

- 84% of PayPal shoppers paying with BNPL had a positive purchase experience (PayPal. (Jan, 2025). Buy now, pay later for merchants: A comprehensive guide )

- 55% higher average order values than standard purchases for large enterprise retailers globally (PayPal. (Jan, 2025). BNPL statistics: What buy now, pay later products are consumers buying? )

PayPal's implementation demonstrates how enterprise-grade AI systems can scale BNPL services while maintaining strict fraud detection capabilities.

The message is clear: AI adoption in BNPL credit decisioning has moved from competitive advantage to business necessity.

Both companies prove that sophisticated machine learning can simultaneously drive growth and maintain strict risk controls through real-time decisioning at enterprise scale. Organizations without AI-driven credit systems risk permanent competitive disadvantage as customer expectations for instant, seamless experiences become the industry standard.

For enterprise-scale fraud detection and risk management solutions, explore TrustDecision’s comprehensive Fraud Management platform designed for high-volume financial services.

Learn about TrustDecision’s comprehensive approach to explainable AI in credit risk that balances performance with transparency requirements.

Technical and Operational Challenges

Successful AI implementation in BNPL requires addressing several technical and operational challenges with proven solutions:

- Legacy system integration - API-first architectures enable gradual migration; microservices deployments isolate AI components from legacy infrastructure

- Data quality and consistency - Comprehensive data governance frameworks with automated validation pipelines and real-time monitoring maintain model performance

- Model interpretability - SHAP and LIME frameworks provide decision transparency required for regulatory compliance and customer communication

- Scalability challenges - Cloud-native deployments with automated scaling ensure consistent performance during peak shopping events

- Talent acquisition - Specialized expertise addressed through vendor partnerships or hybrid models combining internal teams with external expertise

Regulatory Compliance and Ethical AI

Essential compliance requirements include:

- Fair lending compliance - Continuous bias detection and automated fairness testing across protected classes for ECOA compliance

- Privacy regulations - GDPR/CCPA compliance through privacy-by-design approaches, differential privacy, and data minimization strategies

- Model explainability - Audit trails documenting decision factors and automated reporting systems for regulatory examination

- Consumer protection - Transparent decision communication, clear dispute resolution, and proactive customer education about responsible BNPL usage

Future Trends and Strategic Considerations

Can AI-Driven Models Adapt to Market Changes in BNPL Lending?

Next-generation technologies are poised to revolutionize BNPL lending by enhancing personalization, improving risk assessment accuracy, and enabling more sophisticated fraud prevention capabilities:

- Generative AI - Personalized lending experiences, dynamic content generation, and intelligent customer communication

- Open banking integration - Real-time account data access for accurate income verification, particularly benefiting thin-file customers

- Blockchain technology - Immutable identity verification and smart contracts for automated agreement management

- IoT data integration - Context-aware decisions based on device usage patterns, location data, and behavioral biometrics

- Quantum computing - Enhanced optimization algorithms, improved pattern recognition, and breakthrough cryptographic security

For strategic guidance on technology selection and implementation planning, explore TrustDecision’s Application Fraud Detection & Credit Data Insights, designed specifically for digital lending platforms.

Conclusion: Your Next Steps in AI-Driven BNPL Innovation

AI transforms BNPL credit decisioning through measurably better risk outcomes, faster underwriting, and significant operational efficiency gains. For risk managers, lending executives, and fintech founders, AI deployment has become essential for competitive survival.

Market leaders demonstrate substantial ROI through improved approval rates, reduced default losses, and enhanced customer experiences. Organizations delaying AI adoption risk permanent competitive disadvantage as regulatory frameworks evolve and competition intensifies.

Immediate next steps: Assess current data capabilities, regulatory requirements, and competitive positioning to prioritize AI implementation. Begin with pilot programs that demonstrate value while building internal capabilities with TrustDecision.

Book our AI-driven Credit Decisioning demo to explore how our platform can transform your BNPL operations.

Further Reading: